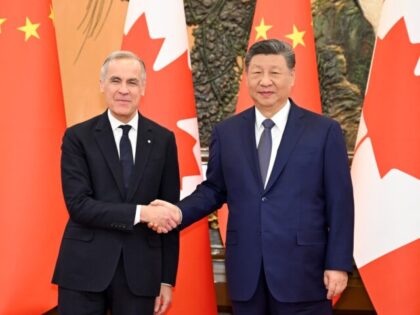

Chinese regulators are quietly telling their biggest banks to dial back on U.S. Treasuries, with Bloomberg dropping the bombshell on Monday. The official line? Concentration risk and market volatility. Translation: Beijing’s spooked by America’s debt mountain—now over $35 trillion—and the wild swings in Treasury yields that could torch their holdings if Uncle Sam keeps printing money like it’s going out of style. This isn’t just financial housekeeping; it’s a geopolitical chess move. China, the world’s largest foreign holder of U.S. debt at around $800 billion, has been dumping Treasuries for months, shifting to gold and other assets. With U.S.-China tensions simmering—from Taiwan to tariffs—this signals eroding confidence in the dollar’s dominance, potentially spiking U.S. borrowing costs as foreign buyers pull back.

For the 2A community, this hits harder than a mag dump at the range. Our gun rights thrive on a stable America: a strong economy funds law enforcement, border security, and the manufacturing muscle behind AR-15s and 1911s. If Treasury yields climb (they’re already flirting with 4.5%), inflation reignites, and the Fed hikes rates, everyday patriots face steeper loans for homes, trucks, and yes, that next firearm purchase. Worse, fiscal chaos could embolden anti-2A politicians to push crisis gun grabs, blaming economic woes on assault weapons while diverting funds from defense to welfare. Remember 2008? Markets tanked, and Obama rode in with ATF overreach. China’s move underscores the fragility of fiat reliance—echoing why gold bugs and Bitcoin bros in the liberty sphere preach self-reliance. Stock up on ammo, diversify your assets, and keep voting for fiscal hawks who prioritize the Second Amendment over endless spending sprees.

The silver lining? This could accelerate the multipolar world 2A advocates crave: less globalist entanglement means fewer UN busybodies meddling in our rights. Watch for Treasury auctions to falter—bid-to-cover ratios dipping below 2.5x would be the canary in the coal mine. Pro-2A investors, pivot to domestic manufacturers like Daniel Defense or Palmetto State Armory; their stocks could boom as buy American sentiment surges. Stay vigilant, armed, and informed—this isn’t just about bonds; it’s about the bedrock of our freedoms.